CFDs, or Contracts for Difference, have gained popularity as a flexible trading instrument in recent years. These derivative products allow traders to speculate on the price movements of various underlying assets without actually owning them. In this article, we’ll explore CFD how it works, how they work, and key considerations for those interested in CFD trading.

Understanding CFDs:

A Contract for Difference is an agreement between a trader and a broker to exchange the difference in the value of a financial instrument between the time the contract opens and closes. CFDs are available for a wide range of assets including stocks, indices, commodities, and currencies.

One of the main advantages of CFDs is the ability to trade on margin, also known as leverage. This means traders can open positions larger than their initial investment, potentially amplifying returns. However, it’s crucial to remember that leverage can also magnify losses.

How CFDs Work:

When trading CFDs, you essentially bet on whether the price of an asset will rise or fall. If you believe the price will increase, you would open a “buy” position (going long). Conversely, if you anticipate a price decrease, you would open a “sell” position (going short).

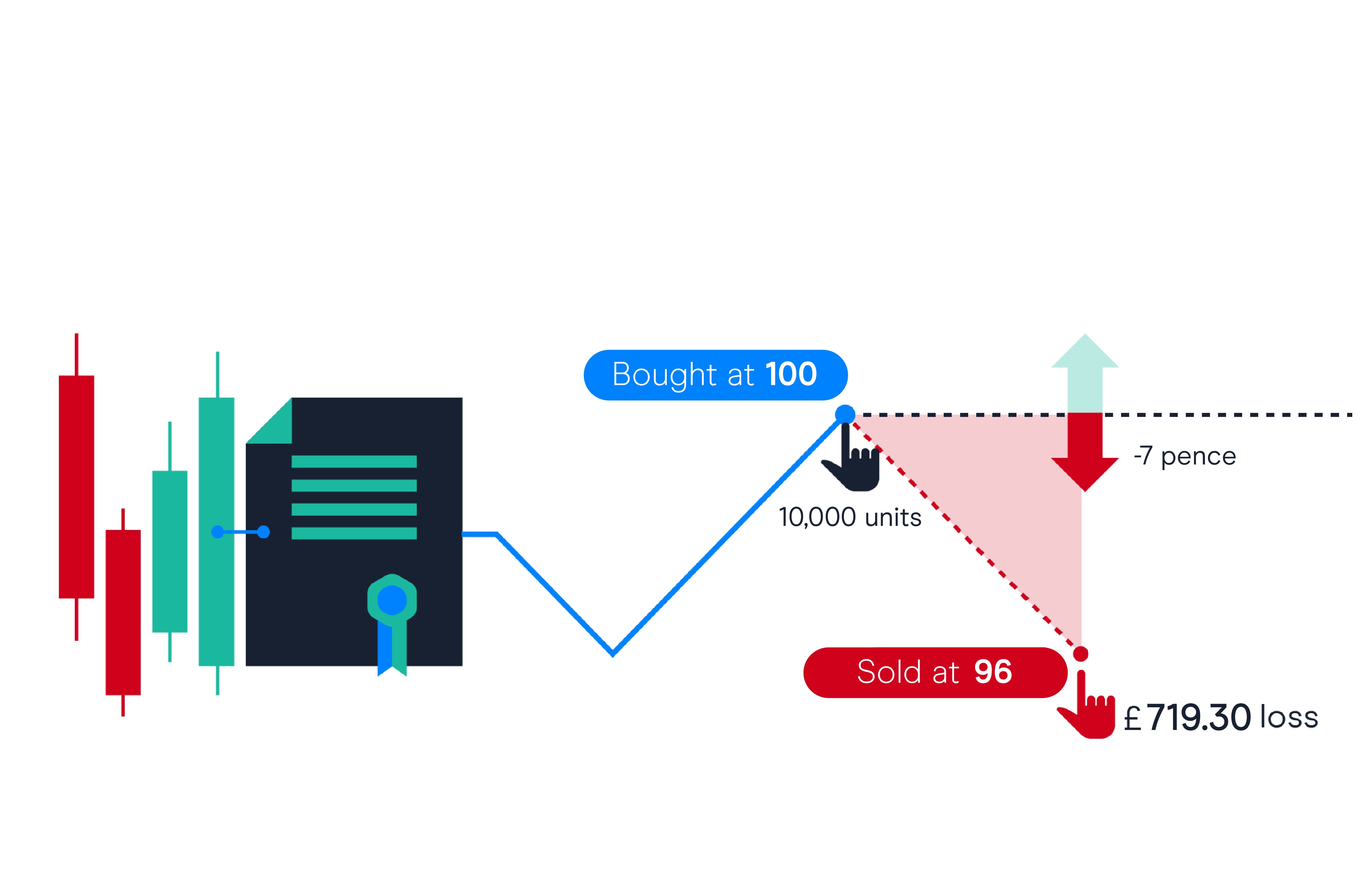

The profit or loss from a CFD trade is determined by the difference between the price when the contract is opened and when it is closed, multiplied by the number of units traded. CFDs mirror the price movements and economic benefits of owning the underlying asset, including any dividend payments or corporate actions for stocks.

Considerations for CFD Traders:

While CFDs offer several benefits such as flexible leverage, the ability to go long or short, and a diverse range of tradable assets, there are also risks to consider. Since CFDs are leveraged products, potential losses can exceed the initial investment.

It’s essential for traders to have a solid understanding of the markets they trade and employ robust risk management strategies. This may include setting appropriate stop-loss orders and managing position sizes based on risk tolerance. Staying informed about market news and events that could impact asset prices is also crucial.

In conclusion, CFDs provide an accessible way for traders to gain exposure to various financial markets without directly owning the underlying assets. By understanding how CFDs work and the associated risks, traders can make informed decisions and potentially capitalize on price movements. As with any form of trading, education, practice, and risk management are key to success in the CFD market.