In the world of trading, risk management is crucial. One of the most effective strategies for managing risk is hedging. This technique allows traders to protect their investments against unfavorable market movements. In this article, we will introduce you to the concept of hedging within the popular trading platform metatrader 4 for windows.

What is Hedging?

Hedging is a strategy used to offset potential losses in one position by taking an opposite position in a related asset. By doing so, traders can mitigate the risks associated with volatile market conditions. While hedging does not eliminate risk entirely, it can significantly reduce the impact of adverse price movements on an existing position.

How Hedging Works in MetaTrader 4

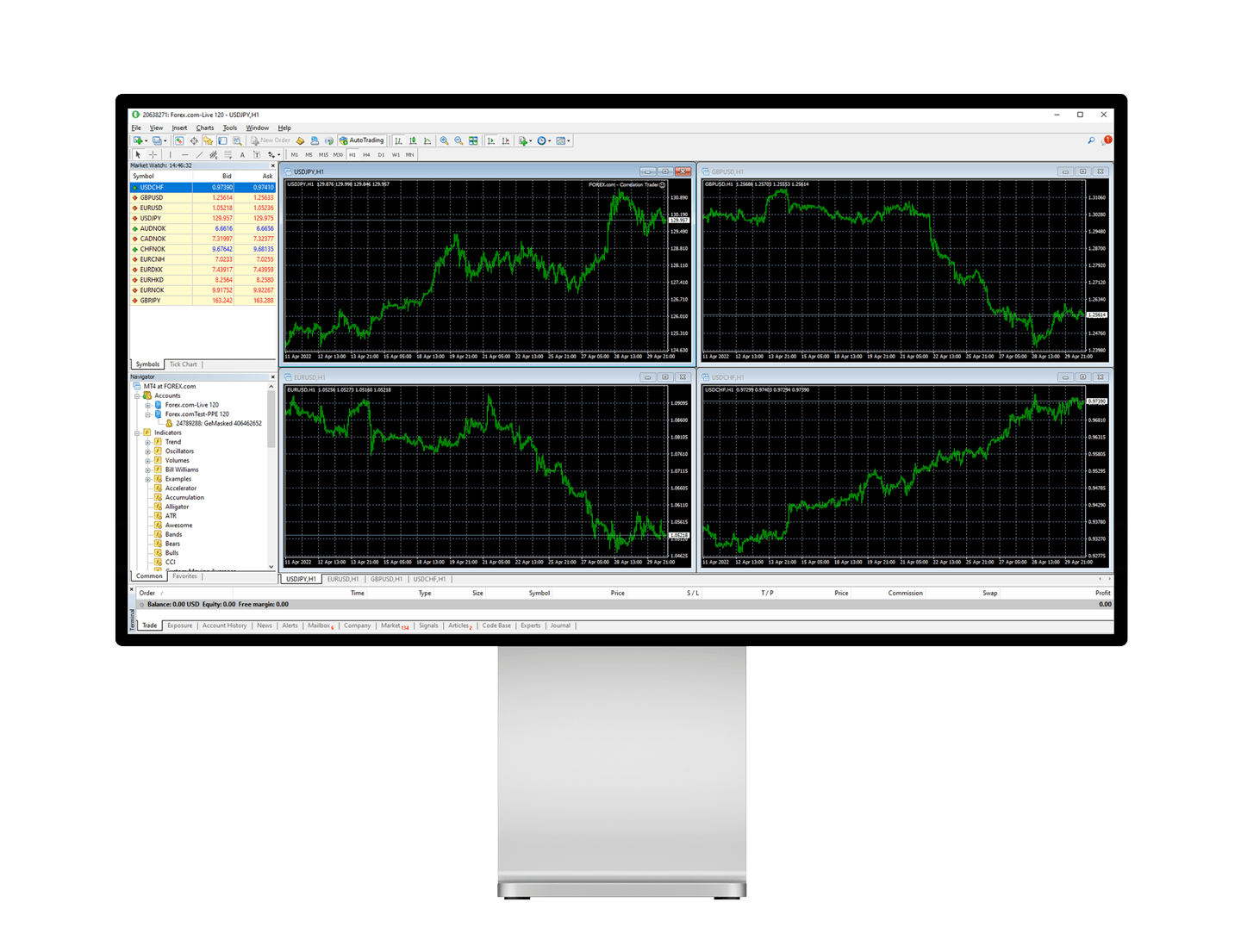

MetaTrader 4 is a widely-used trading platform that offers robust tools for implementing various trading strategies, including hedging. Here’s a step-by-step guide to understanding how hedging works in MT4:

Open Multiple Positions

In MT4, you can open multiple positions in the same or correlated instruments. For example, if you have a long position in EUR/USD, you can hedge this position by opening a short position in the same currency pair. This way, any losses in the long position can be offset by gains in the short position.

Utilize Stop Loss and Take Profit Orders

To effectively manage your hedging strategy, use stop loss and take profit orders. These orders automatically close your positions when the market reaches a certain price level, helping you lock in profits or limit losses. By setting these orders, you can ensure that your hedging strategy is executed as planned.

Monitor Correlated Assets

Hedging can also be applied to correlated assets. For instance, if you have a position in a stock index, you can hedge it by taking an opposite position in a related commodity or currency. MT4 allows you to monitor and trade multiple instruments simultaneously, making it easier to implement such strategies.

Benefits of Hedging in MetaTrader 4

1. Risk Management: Hedging helps you manage risk by offsetting potential losses in one position with gains in another.

2. Flexibility: MT4 provides a flexible trading environment where you can easily open and manage multiple positions.

3. Advanced Tools: The platform offers advanced tools like stop loss and take profit orders, which enhance the effectiveness of your hedging strategy.

Conclusion

Hedging is a valuable strategy for managing risk in trading. MetaTrader 4’s robust features and tools make it an ideal platform for implementing hedging strategies. By understanding and utilizing hedging in MT4, you can protect your investments and navigate the volatile markets with greater confidence.