When it comes to building a robust investment portfolio, diversification is a principle that experienced investors swear by. online trading has emerged as a key tool allowing individuals the flexibility and accessibility to achieve this essential diversification. With markets becoming increasingly interconnected and technology paving the way for easy access to global assets, online trading is revolutionizing how we manage our investments.

The Importance of Diversification

Diversification is the practice of spreading your investments across asset classes to minimize risk and enhance potential returns. Think of it as not putting all your eggs in one basket. The goal is to counterbalance the performance of one asset with another, reducing your overall portfolio’s exposure to market fluctuations.

Historically, diversified portfolios that include a mix of stocks, bonds, commodities, and other asset classes have shown more stability compared to portfolios concentrated in a single asset. Studies show that diversification can reduce portfolio volatility by up to 50%, depending on the ratio of assets selected.

How Online Trading Supports Diversification

Online trading platforms make it easier than ever to access a vast array of financial instruments to diversify your portfolio. Here are some of the key ways online trading plays a pivotal role:

• Access to Global Markets

With websites and applications offering exposure to international markets, you can purchase stocks in the U.S., bonds in Europe, or ETFs in Asia—all from the comfort of your home. This allows investors to balance risk by leveraging regional market opportunities.

• Range of Assets

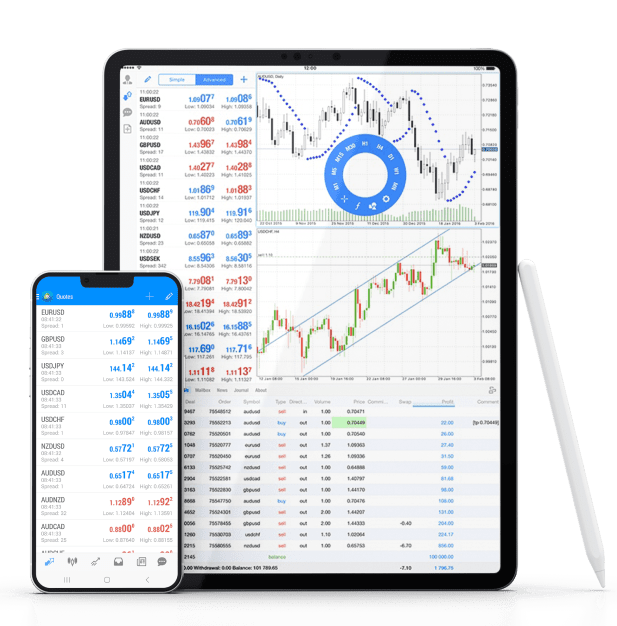

Online trading platforms often provide access to diverse asset classes, including stocks, forex, commodities, ETFs, and cryptocurrencies. This range enables investors to align their portfolios with both long- and short-term market strategies.

• Real-Time Data and Analytics

Investors can utilize real-time charts and tools to spot opportunities across asset classes. For example, identifying trends in gold prices can complement equity-focused strategies during turbulent stock market periods.

Why Diversifying with Online Trading is Trending

The accessibility and user-friendly features of online trading platforms have made diversification a trend among retail investors. Research shows that the number of individuals trading online globally has grown by over 50% in the past decade, with diversification remaining a primary objective for many. Online trading ensures that even with modest capital, investors can partake in asset allocation strategies that were previously reserved for institutional investors.

Next Steps for Aspiring Investors

Markets evolve rapidly, but the principle of diversification remains steadfast. Online trading offers new pathways to build a resilient portfolio, empowering investors to take control of their financial future.

By utilizing online tools and exploring global opportunities, individual investors can construct a well-rounded portfolio while minimizing risks. Take the first step toward diversification today, and set yourself up for potential long-term success.